如果你不做,機會是零。做的話,即使千萬分之ㄧ也是機會 / 愛要耐心等待仔細尋找感覺很重要 / 停損是一種美德,"貪"跟"貧"只差一劃而已 / 如果你接受不到,那你應該不要開始,而不是在開始了之後,才去覺得辛苦,不開心,而妄想去改變事情。/ 你不會作期貨的時候,你就想想撲克牌要怎麼打,期貨就是那樣作。/ 常常有投資人會問 現在適不適合買進 其實真正要問的是 適合買進就真的可以買進了嗎 不要期望得到別人的答案 因為別人的風險不是你能夠所承擔的 也不是一買進後馬上就會飆漲 你把你自己的帳戶損益 交給別人”建議”是很不切實際的 更何況當您得知適合買進的時候 可能只是在幫人抬轎 交易要對自己負責 因為買進也是有風險的

nuffnang

Sunday, March 22, 2009

Brilliant Bank - A Fairytale With A Conflict Of Interest?

Friday, March 20, 2009

Brilliant Bank - A Fairytale With A Conflict Of Interest?

Once upon a time there was a successful bank called Brilliant Bank. It grew more than 10% every year for the past 20 years and then successfully ventured into fund management. Brilliant Bank had the best return on capital, best return on assets, the lowest NPLs and the highest capital adequacy ratio among all other banks in the country. Heck, it even compares very well with other banks in the region.

Thanks to their steady and careful management culture, their fund management business also witnessed similar growth patterns as the bank. The fund management unit is 100% owned by the bank. Funds under management grew exponentially. After a few years they have about 20 pure equity or equity linked funds. The total funds under management for equities may well be around RM10bn. The total market cap for the bank is around RM20bn.

The unique thing is that in almost every single fund, Brilliant Bank shares will almost always be one of their top 3 holdings. Fair enough that Brilliant Bank has performed exceedingly well over the long term, and that in turn has helped many of the funds to outperform the irrespective indices. But surely everyone can see that this has to be a gray area when you want to talk of things like transparency, conflict of interest areas, corporate integrity issues, etc.

So much so that the amount of shares held by the "funds" in Brilliant Bank may reach 5%-10% of free float of the bank. Decisions are made by fund managers, working in a fund management unit 100% owned by Brilliant Bank. Really, nobody sees any conflict of interest here??!!

Anyway,in this fictional story, nobody complained because Brilliant Bank performed well, and hence the funds also performed well. There will come a time, if and when Brilliant Bank digs a hole in some financial exposure, and say loses 70% in value over a short period of time. Can we expect the unit holders of the funds to start complaining then? If that happens, what will be the repercussions if the funds were to buy even more shares in Brilliant Bank.

When is buying substantive shares considered as "supporting the share price", and when it is not? If the action is done by one party, that is easy to gather evidence, but what if the buying is by 20 funds? When can we say there is collusion, and when there is no collusion.

I am just writing a fictional story (gulp), but maybe certain things are even more obvious in reality than in fiction. In order to prevent this fictional story from becoming a non-fiction tragedy, I would like the Securities Commission to look closer to the following rules or conventions:

a) do we have a clear guideline when a majority owned fund management unit buys shares in related companies; there must be guideline on percentage of funds' exposure and even minimum time line in holding the shares; there must be safeguards that minority shareholders will not be disadvantaged by the timing of the trades that these funds enter into

b)there must be utmost transparency in how much shares, at what price,and when were the shares acquired and disposed to all unit holders

In the mean time, Brilliant Bank continues on its merry ways by producing good results and getting liquidity mopped up by the ever growing fund management unit. You scratch my back, I scratch your back... but hey,your back is my back!!

Who is brilliant bank, haha, everyone in msia knew it...

Saturday, March 21, 2009

年薪10萬的乞丐給我上了震撼的一課

我拎著剛買的levi's 從茂業出來,站在門口等一個朋友。

一個職業乞丐發現了我,非常專業的、徑直的停在我面前。這一停,於是就有了後面這個讓我深感震撼的故事,就像上了一堂生動的市場調查案例課。為了忠實於這個乞丐的原意,我憑記憶盡量重複他原來的話。

"先生 …… 行行好,給點吧。"我一時無聊便在口袋裡找出一個硬幣扔給他並同他攀談起來。

乞丐很健談。 " …… 我只在華強北一帶乞討,你知道嗎?我一掃眼就見到你。在茂業買 levi's ,一定捨得花錢 …… "

"哦?你懂的蠻多嘛!"我很驚訝。

"做乞丐,也要用科學的方法。"他說。

我一愣,饒有興趣地問"什麼科學的方法?"

"你看看我和其他乞丐有什麼不同的地方先?"我仔細打量他,頭髮很亂、衣服很破、手很瘦,但都不髒。

他打斷我的思考,說:"人們對乞丐都很反感,但我相信你並沒有反感我,這點我看的出來。這就是我與其他乞丐的不同之處。"

我點頭默認,確實不反感,要不我怎麼同一個乞丐攀談起來。

"我懂得 swot 分析,優勢、劣勢、機會和威脅。對於我的競爭對手,我的優勢是我不令人反感。機會和威脅都是外在因素,無非是深圳人口多和深圳將要市容整改等。"

"我做過精確的計算。這裡每天人流上萬,窮人多,有錢人更多。理論上講,我若是每天向每人討 1 塊錢,那我每月就能掙 30 萬。但是,並不是每個人都會給,而且每天也討不了這麼多人。所以,我得分析,哪些是目標客戶,哪些是潛在客戶。"他潤潤嗓子繼續說,"在華強北區域,我的目標客戶是總人流量的 3 成,成功機率 70% 。潛在客戶佔 2 成,成功機率 50% ;剩下 5 成,我選擇放棄,因為我沒有足夠的時間在他們身上碰運氣。"

"那你是怎樣定義你的客戶呢?"我追問。

"首先,目標客戶。就像你這樣的年輕先生,有經濟基礎,出手大方。另外還有那些情侶也屬於我的目標客戶,他們為了在異性面前不丟面子也會大方施捨。其次,我把獨自一人的漂亮女孩看作潛在客戶,因為她們害怕糾纏,所以多數會花錢免災。這兩類群體,年齡都控制在 20~30 歲。年齡太小,沒什麼經濟基礎;年齡太大,可能已結婚,財政大權掌握在老婆手中。這類人,根本沒戲,恨不得反過來找我要錢。"

"那你每天能討多少錢。"我繼續問。

"週一到週五,生意差點,兩百塊左右吧。週末,甚至可以討到四、五百。"

"這麼多?"

見我有些懷疑,他給我算了一筆帳。 "和你們一樣,我也是每天工作 8 小時,上午 11 點到晚上 7 點,週末正常上班。我每乞討 1 次的時間大概為 5 秒鐘,扣除來回走動和搜索目標的時間,大概 1 分鐘乞討 1 次得 1 塊錢, 8 個小時就是 480 塊,再乘以成功機率 60%[ ( 70%+50% )÷ 2] ,得到將近 300 塊。"

"千萬不能黏著客戶滿街跑。如果乞討不成,我決不死纏濫打。因為他若肯給錢的話早就給了,所以就算腆著臉糾纏,成功的機會還是很小。不能將有限的時間浪費在無施捨慾望的客戶身上,不如轉而尋找下一個目標。"

強!

這個乞丐聽上去真不可貌相,倒像是一位資深的市場營銷總監。

"你接著說。"我更感興趣了,看來今天能學到新的東西了。

"有人說做乞丐是靠運氣吃飯,我不以然。給你舉個例子,女人世界門口,一個帥氣的男生,一個漂亮的女孩,你選哪一個乞討?"

我想了想,說不知道。

"你應該去男的那兒。身邊就是美女,他不好意思不給。但你要去了女的那邊,她大可假裝害怕你遠遠地躲開。"

"再給你舉個例子。那天cocopark門口,一個年輕女孩,拿著一個購物袋,剛買完東西;還有一對青年男女,吃著冰淇淋;第三個是衣著考究的年輕男子,拿著筆記本包。我看一個人只要3秒鐘,我毫不猶豫地走到女孩面前乞討。女孩在袋子裡掏出兩個硬幣扔給我,並奇怪我為什麼只找她乞討。我回答說,那對情侶,在吃東西,不方便掏錢;那個男的是高級白領,身上可能沒有零錢;你剛從超市買東西出來,身上肯定有零錢。"

有道理!

我越聽越有意思。

"所以我說,知識決定一切!"我聽十幾個總裁講過這句話,第一次聽乞丐也這麼說。

"要用科學的方法來乞討。天天躺在天橋上,怎麼能討到錢?走天橋的都是行色匆匆的路人,誰沒事走天橋玩,爬上爬下的多累。要用知識武裝自己,學習知識可以把一個人變得很聰明,聰明的人不斷學習知識就可以變成人才。21世紀最需要的是什麼?就是人才。"

"有一次,一人給我50塊錢,讓我替他在樓下喊'安紅,我想你',喊100聲。我一合計,喊一聲得花5秒鐘,跟我乞討一次花費的時間相當,所得的酬勞才5毛錢,於是我拒絕了他。"

"在深圳,一般一個乞丐每月能討個千兒八百。運氣好時的大概兩千多點。全深圳十萬個乞丐,大概只有十個乞丐,每月能討到一萬以上。我就是這萬里挑一中的一個。而且很穩定,基本不會有很大的波動。"

太強了!

我越發佩服這個乞丐了。

"我常說我是一個快樂的乞丐。其他乞丐說是因為我討的錢多,所以快樂。我對他們說,你們正好錯了。正是因為我有快樂、積極的心態,所以討的錢多。"

說的多好啊!

"乞討就是我的工作,要懂得體味工作帶來的樂趣。雨天人流稀少的時候,其他乞丐都在抱怨或者睡覺。千萬不要這 樣,用心感受一下這坐城市的美。晚上下班後帶著老婆孩子逛街玩耍看夜景,一家三口其樂融融,也不枉此生了。若是碰到同行,有時也會扔個硬幣,看著他們高興 的道謝走開,就彷彿看見自己的身影。"

"你還有老婆孩子?"我不禁大聲讚歎,引來路人側目。

"我老婆在家做全職太太,孩子念小學。我在福田區買了一套房,十年分期,還差六年就還清了。我要努力掙錢,供我兒子讀大學念市場營銷專業,然後子承父業當一個比我更出色的乞丐。"

"我5年前在微硬中華大區做市場策劃,2年前升為營銷經理,月薪5千。那時買了一台1萬多的三星筆記本,每個月還款2千,要死要活的。後來我想這樣永遠也出不了頭,就辭職不干了,下海來做乞丐,我願意做一個高素質的乞丐。"

聽完,我激動地說:"你有沒有興趣收我做徒弟…… "

Monday, March 16, 2009

云顶名胜图(版权: 弹煮)

股价跌破“超长期”涨势趋势线,乃大凶。

各位要么把买入目标价设在23.6%回退线也就是RM1.52,要么就等待股价重新冲破该趋势线的移动阻力。

把resorts图的分析模式套用在云顶图上,可见23.6%回退线在RM3.24,很接近今天的闭市价。

然而,从长期涨势趋势线来看,支持线理应在RM2.50左右。

投资者可分两次买入:首次3.24,第二次的价位需视移动趋势线位置。

【分析完毕】

你還在靠廣告買基金嗎?

網友推薦:共有 52 人推薦 (有 53 人投票)

在投資理財的領域中,許多上班族存有一個迷思,以為自己不懂投資,完全對理財是外行的,只好靠著財經專家來協助理財。

至於所謂的「財經專家」,是指什麼呢?

多數時候,投資人是被所謂的「紙上專家」所眩惑住了。因為業者砸經費製作精美的廣告,以投資美好的未來作為主訴求,進而將業者所代理的投資商品、銷售人員,一一點石成金,讓散戶相信只要把錢交給這些「財經專家」,就會有真實且炫目的財富存在。

事實上,這類財經專家只是廣告所塑造出來,讓投資人覺得可以安心,進而放心在市場作投資的假象。

在為數眾多的財富管理廣告當中,我覺得,共同基金因為強調簡單、安全與委託專家進行操作,因此最能打動上班族的心,並捨得將銀行存款裡的血汗錢,以定期定額加長期投資的方式,搬移到共同基金的帳戶裡頭去。

一如財富管理廣告所訴求的,投資人以為自己得到了黃金人生,彷彿只要手上握有一檔或數檔基金,未來的人生就是美好的、鍍金的,充滿了亮麗的色彩。

但問題是,共同基金的申購書上,明明用白紙黑字寫著:「投資基金不代表絕無風險,投資人申購前應詳閱公開說明書。」投資人申購了一檔基金以後,還要自負投資盈虧,那麼,到底投資人繳了那麼多的基金管理費用,得到的是什麼呢?

更何況,無數的基金管理費用並非單純拿來供養一個專業的研究團隊與基金經理人而已,從報章雜誌所充斥的無數財富管理廣告來看,基金投資人所定期繳交的管理費用,其實多數都權充基金的行銷、廣告與品牌費用。

投資人花了那麼多的錢,其實卻是自掏腰包,幫業者做了廣告,最後只是換來一場「紙上富貴」或「黃梁一夢」。

從去年全球金融風暴發生以來,共同基金就已被證明是淨值非常不穩定的投資工具。問題不是出在基金這種商品有何問題,因為基金跟股票投資一樣,都是有風險的,投資人本來就必須自行承擔風險。

但問題出在,基金業者透過廣告、行銷與新聞公關方式所形塑出來的基金美好印象,讓多數上班族完全忘卻「風險」的存在,進而像吸食嗎啡或大麻一般,自己以為將擁有未來真實的財富,但實際上,這些財富卻奠基在市場的高度波動中,充滿著不確定性。

投資基金必須靠投資人自己掌握風險趨避原則,靠自己掌握投資的遊戲規則與市場趨勢,而不是定期定額加長期投資,就能夠傻傻的賺到錢。除非投資人自己具有「有錢人」的投資腦袋,否則,靠品牌廣告所加持出來的「有錢人」迷思,完全是夢幻的、虛無飄渺的。

投資靠他人是行不通的,買基金靠廣告也是不明智的,而業者靠誇張廣告來銷售基金,更是不道德的。

同樣的行銷費用,業者應該拿來教育理財門外漢,讓投資人理解什麼叫資產配置?什麼叫財務規劃?什麼叫理財計劃?如此,才有可讓財富管理市場進入雙贏的良性循環。

Thursday, March 12, 2009

投资盈利及税收被滥用 柔州财政缺口成无底洞

投资盈利及税收被滥用 柔州财政缺口成无底洞

【柔佛·庄德志】柔佛州有过这样活生生的例子:一名在地方议会中稳坐第一把交椅的公务员,每月薪金大约在马币五千元左右,再服务几个月便退休,并开始享有相当于原来薪金半数的养老金,直到终老。不过就在快退休前的几个月,这名公务员“忽然”被州政府调派到属下的发展机构任职,并支领每个月马币一万五千元的薪金。当然,不出几个月,这名公务员还是依循时间表退休,不过退休后享有的养老金,从原本的马币两千余元,变成马币七千余元。

数学或逻辑再差的人也明白,这等同是退休以后支领的养老金数额,比在任地方议会大官时的薪金还要高。简单地说,只要在退休前临门“一调”,退休后所得比退休前在地方议会任职的收入还优渥。

值得一提的是,这名“幸运”的公务员被调派时,其太太正在州政府中担任高职,几乎泰半的地方议会同僚都不禁感叹,只要有自己人在上头,退休比继续任职好。

类似现象在柔佛州比比皆是,就算当官的没有自己人在“上头”斡旋,只要人脉关系好,事无巨细如大选期间又特别能够配合国阵,就随时能在退休后享有比退休前更佳的待遇。

砸钱养球队

因此,州政府属下柔佛机构(Johor Corporation),前身是柔佛州经济发展机构(Johor State Economic Development Corporation),除了是一个协助州政府投资种植、地产、医疗等业务的臂膀,往往也成为州政府安置特定人士的摇篮。

当然,摇篮的方式也很多,打着推广全民运动的旗号,柔佛机构自1972年便成立了柔佛州足球队(Johor Football Club),且在1997年开创JKing运动服装品牌。柔佛机构除了支付球员、教练及各级职员的薪水之外,也在柔南斥资建造专用体育馆及球场共球队使 用。1997至1998年面对经济风暴打击时,足球队购入了数十辆价值不菲的奥迪(Audi)轿车做为管理人员的专用车,而这些账单都由柔佛机构在支付。

当然,毫无意外的,足球队仍没在马来西亚足球联赛中有杰出表现,而所谓JKing品牌的运动服饰,确实在宣传上砸钱,却没有看到任何实际建树。

单从公务人员在临退休前的“临门一调”及球队奢侈作风的例子,就已经能理解州政府投资臂膀的功能,也知道人民税收和投资盈利是怎么被滥用,这间接解释了州政府为什么曾面对濒临破产的窘境。

投资机构业绩不俗

如果说由州务大臣领头,州政府高官及私人界翘楚组成的柔佛机构不具备经济效益,那是非常不公平且过于武断的。就以柔佛机构众多业务里其中一家种植业上市公 司 Kulim (Malaysia) Berhad为例,该公司及旗下子公司的业绩表现向来便处于稳定水平,且在棕榈种植的研究工作上有不俗的表现。

该公司截至2008年12月的税前盈利达到了马币1亿2915万元,而该公司在马来西亚半岛、巴布亚新几内亚、所罗门群岛所拥有的棕榈圜丘达到 124,660公顷(HA)。(这只是柔佛机构投资的其中一项业务,还不包括饮食、酒店、医疗及基金等业务。详情可从柔佛机构网站获得)。

其实,问题的关键根本不在于柔佛机构的投资对象表现如何,也不在地方税收的成绩如何,而是柔佛机构及州政府是否真正善用投资盈利及税收,用在有利于柔佛州 及州子民的发展?抑或是,州政府非常典型的将大笔大笔的投资盈利透过各种手段瓜分到高官显要的口袋,甚至将白花花的银两用在百变养老金计划?

当然,这种种怪象应得正视及矫正,而柔佛州在野党若准备在不久的将来争取执政机会,就务必研究和调查这些比起水沟阻塞还要严重及牵涉面广的问题;至少在具备野心夺取政权之前,在野党亦应该有足够的专业和知识,全面监督和制衡州政府。

--------------------------------------------------------------------------------------------------

这几天 雪州 州政府 陆续 揭露 前朝 如何 滥用老百姓血汗钱 ,

当时 就在想 不知道 柔州的会如何 ....为何 年年财政都有赤字...........

果然让我 发现一边 报道 ,贴上来与各位 分享 ..................

Wednesday, March 4, 2009

Candlestick Patterns 日本阴阳烛

Candlesticks

The Japanese have been using candlesticks since the 17th century to analyze rice prices. Candlesticks were introduced into modern technical analysis by Steve Nison in his book Japanese Candlestick Charting Techniques.

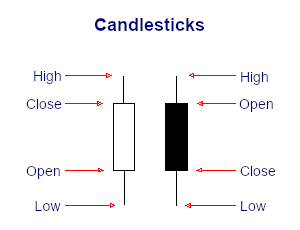

Candlesticks contain the same data as a normal bar chart but highlight the relationship between opening and closing prices. The narrow stick represents the range of prices traded during the period (high to low) while the broad mid-section represents the opening and closing prices for the period.

- If the close is higher than the open - the candlestick mid-section is hollow or shaded blue/green.

- If the open is higher than the close - the candlestick mid-section is filled in or shaded red.

The advantage of candlesticks is the ability to highlight trend weakness and reversal signals that may not be apparent on a normal bar chart.

Shadow and Tail

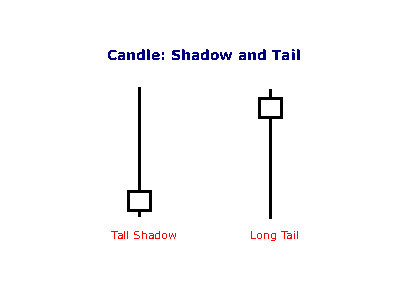

The shadow is the portion of the trading range outside of the body. We often refer to a candlestick as having a tall shadow or a long tail.

- A tall shadow indicates resistance;

- A long tail signals support.

Candlestick Colors

For improved presentation, Incredible Charts uses colors such as red and blue/green to indicate filled or hollow candlesticks:

- Blue (or green) candlestick if the close is higher than the open;

- Red candlestick if the open is higher than the close (i.e. the candlestick is filled);

- The same color as the previous day, if the open is equal to the close.

|

Candlestick Patterns

Long Lines

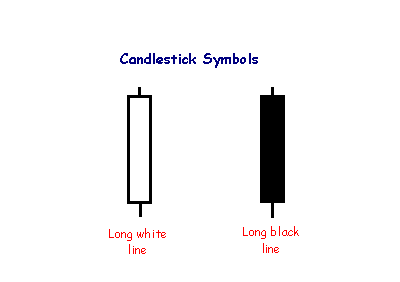

The long white line is a sign that buyers are firmly in control - a bullish candlestick.

A long black line shows that sellers are in control - definitely bearish.

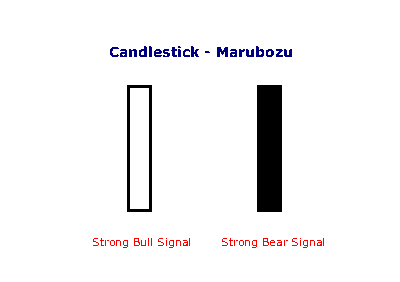

Marubozu Candlesticks

Marubozu are even stronger bull or bear signals than long lines as they show that buyers/sellers have remained in control from the open to the close -- there are no intra-day retracements.

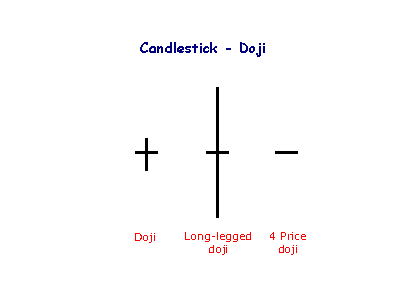

Doji Candlesticks

The doji candlestick occurs when the open and closing price are equal.

An open and close in the middle of the candlestick signal indecision. Long-legged dojis, when they occur after small candlesticks, indicate a surge in volatility and warn of a potential trend change. 4 Price dojis, where the high and low are equal, are normally only seen on thinly traded stocks.

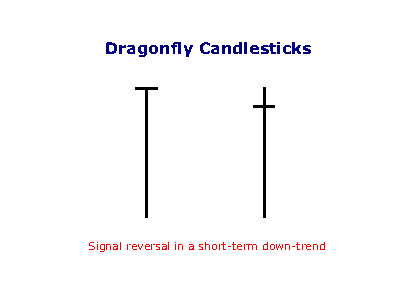

Dragonfly

The dragonfly occurs when the open and close are near the top of the candlestick and signals reversal after a down-trend: control has shifted from sellers to buyers.

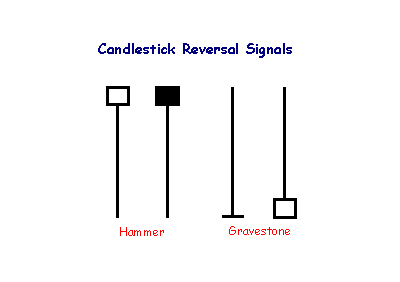

Hammer and Gravestone

The hammer is not as strong as the dragonfly candlestick, but also signals reversal after a down-trend: control has shifted from sellers to buyers. The shadow of the candlestick should be at least twice the height of the body.

A gravestone is identified by open and close near the bottom of the trading range. The candlestick is the converse of a hammer and signals reversal when it occurs after an up-trend.

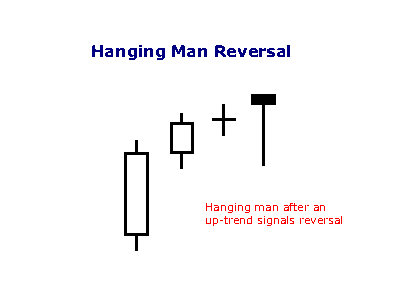

Hanging Man

A hammer that occurs after an up trend is called a 'hanging man' and is a bearish signal.

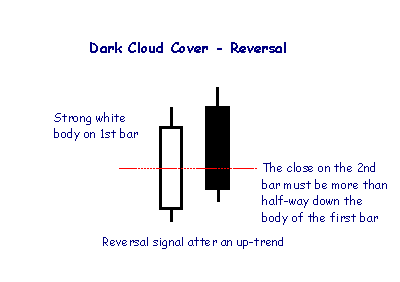

Dark Cloud

A Dark Cloud pattern encountered after an up-trend is a reversal signal, warning of "rainy days" ahead.

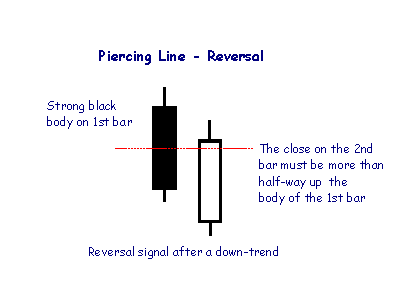

Piercing Line

The Piercing Line is the opposite of the Dark Cloud pattern and is a reversal signal if it appears after a down-trend.

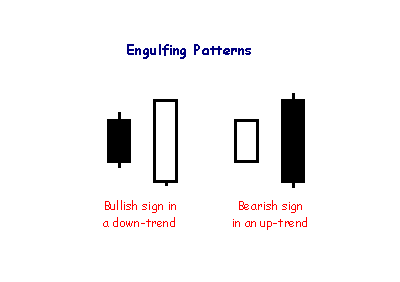

Engulfing Candlesticks

Engulfing patterns are where the body of the second candlestick 'engulfs' the first. They often follow or complete doji, hammer or gravestone patterns and signal reversal in the short-term trend.

Star Formations

Stars are similar to gaps. A long body followed by a much shorter candlestick with a short body, where the bodies must not overlap -- though their shadows may.

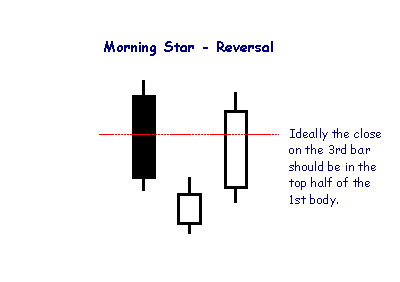

Morning Star

The Morning Star pattern signals a bullish reversal after a down-trend. The first candlestick has a long black body. The second candlestick gaps down from the first (the bodies display a gap, but the shadows may still overlap) and is more bullish if hollow. The next candlestick has a long white body which closes in the top half of the body of the first candlestick.

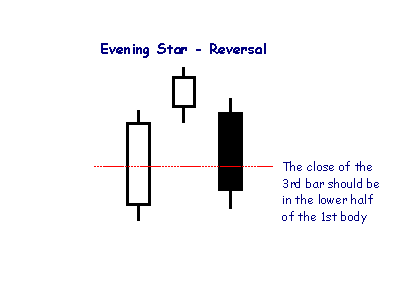

Evening Star

The Evening Star pattern is opposite to Morning Star and is a reversal signal at the end of an up-trend. The pattern is more bearish if the second candlestick is filled rather than hollow.

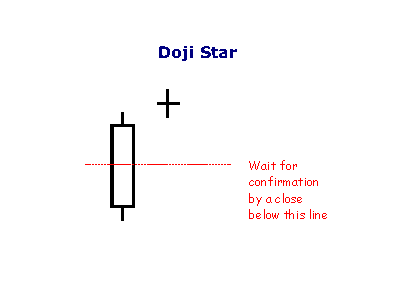

Doji Star

A Doji Star is weaker than the Morning or Evening Star: the doji represents indecision. The doji star requires confirmation from the next candlestick closing in the bottom half of the body of the first candlestick.

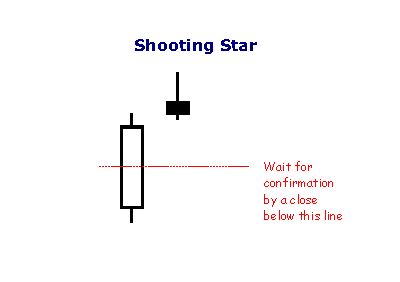

Shooting Star

With a Shooting Star, the body on the second candlestick must be near the low -- at the bottom end of the trading range -- and the upper shadow must be taller. This is also a weaker reversal signal than the Morning or Evening Star.

The pattern requires confirmation from the next candlestick closing below half-way on the body of the first.

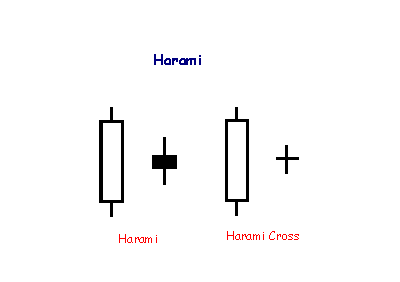

Harami Candlestick

A Harami formation indicates loss of momentum and often warns of reversal after a strong trend. Harami means 'pregnant' which is quite descriptive. The second candlestick must be contained within the body of the first, though the shadows may protrude slightly.

|

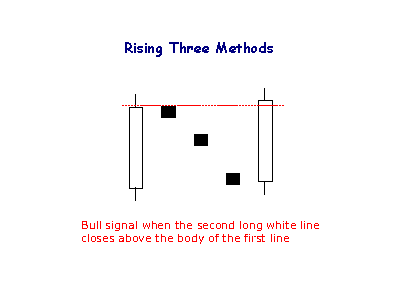

Rising Three Methods

The Rising Method consists of two strong white lines bracketing 3 or 4 small declining black candlesticks. The final white line forms a new closing high. The pattern is definitely bullish.

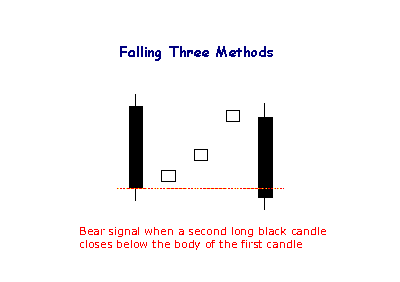

Falling Three Methods

The bearish Falling Method consists of two long black lines bracketing 3 or 4 small ascending white candlesticks, the second black line forming a new closing low.

Evaluation

While candlesticks may offer useful pointers as to short-term direction, trading on the strength of candlestick signals alone is not advisable. Jack Schwager in Technical Analysis conducted fairly extensive tests with candlesticks over a number of markets with disappointing results.